By Peter Simpson, OneTick Product Owner. Demonstrated in webinar broadcasted May 7th, 2025

With OneTick Cloud, you can leverage global on-demand Level 3 market data to analyze market structure for specific CME products. By combining the power of SQL, Python, and a visual analytics interface, traders and analysts can calculate book depth metrics, identify participant behavior, and uncover hidden liquidity in the order book.

Below are the key takeaways and capabilities of the OneTick Cloud platform, which we covered during the webinar on May 7th.

Accessing Granular Level 3 Data

For this analysis, we utilized the CME sample database, looking specifically at the front month S&P 500 E-mini futures,. While Level 1 data gives us trades and quotes, the true insights lie in the Level 3 Market by Order data, which we store in the PRL full table. This dataset includes critical details for every update, such as order ID, update type, side, price, visible size, and fill size.

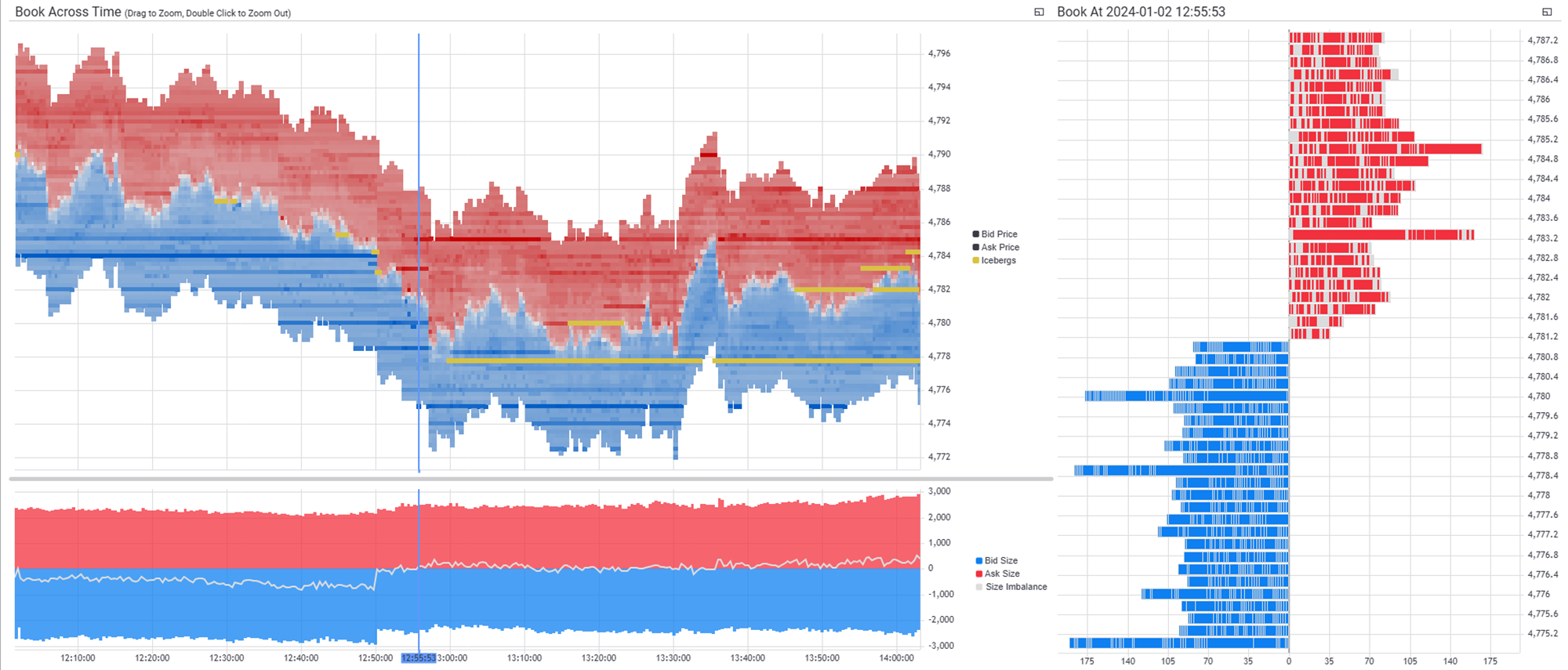

Visualizing Book Depth and Liquidity

Before diving into code, we used the OneTick dashboard to visualize the data. We rebuilt the book from underlying order messages on the fly, visualizing liquidity intensity and identifying specific order types.

- Color Intensity: We used color shading to represent the volume of visible quantity available at specific price levels, allowing us to spot large resting orders across time.

- Iceberg Detection: The visualization highlighted "iceberg" orders in yellow, showing where hidden liquidity was interacting with the market.

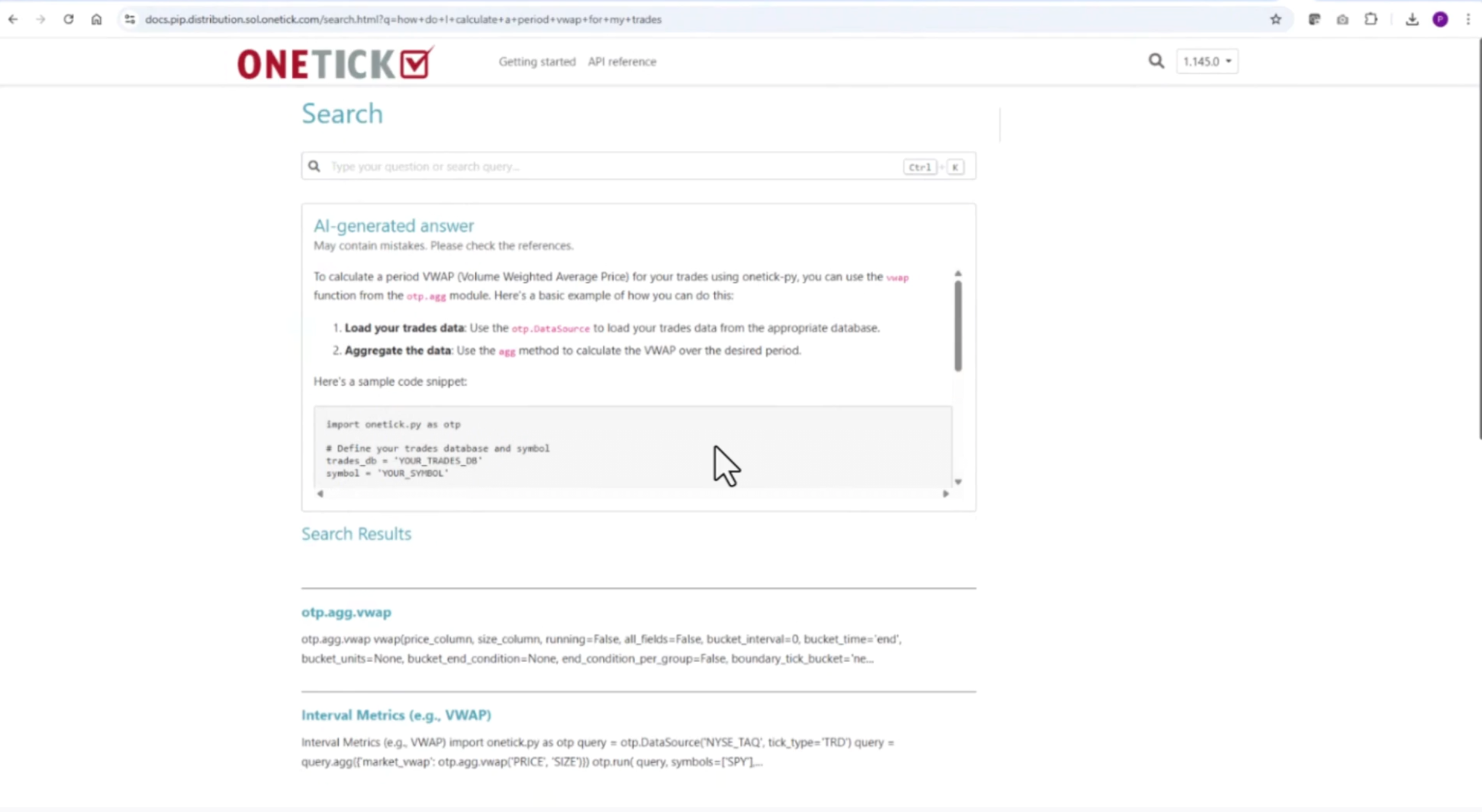

The Power of onetick.py and OB Snapshot

Moving from visual to programmatic analysis, we utilized OneTick’s Python pandas-style API (onetick-py). A core capability we demonstrated was the OB snapshot function. This function allows users to retrieve the state of the order book at a specific nanosecond or across a time range.

We demonstrated how to:

- Rebuild the Book: Generate book snapshots down to 5, 10, or 25 levels of depth.

- Analyze Market Impact: Calculate the VWAP (Volume Weighted Average Price) required to trade a specific quantity (e.g., 100 contracts) and determine how many levels deep one would need to go to execute that order.

- Format Flexibility: Users can retrieve data in various structures—flat rows representing the whole book, or detailed rows for each price level and side—depending on the downstream analysis required.

Uncovering "Trade Throughs" and Imbalances

We explored complex queries to analyze aggressive trading behavior. We identified instances where a single aggressive order "ate" through multiple levels of the book. By tracking the state changes across timestamps, we could calculate exactly how deep a trade went—for instance, identifying a five-minute window where trades repeatedly swept through 3 to 12 levels of the book.

We also calculated order book imbalance by aggregating bid and ask sizes at different depths (e.g., top of book vs. 10 levels deep) to identify liquidity pressure points throughout the trading day.

Detecting Hidden Liquidity: Icebergs and Synthetic Orders

Finally, we tackled the detection of hidden orders using the rich history provided by CME order messages.

- True Icebergs: We identified orders where the fill size was greater than the visible size. By filtering for these partial fills, we could map out active icebergs on the book.

- Synthetic Icebergs: We also looked for synthetic icebergs—algo-driven orders that reload quantity. We calculated the duration between a fill and a new order addition at the same price. Our histogram analysis revealed a distinct frequency bump between 100 and 300 microseconds, a strong signature of synthetic iceberg activity.

next steps

Whether you are rebuilding order books, calculating trade performance metrics, or generating trading signals, OneTick Cloud provides the necessary building blocks to focus on analytics rather than infrastructure.

To experience these capabilities firsthand and access global market data:

Visit onetick.com/cloud-services and click the "Login or Create a Trial Account" button to register.

To learn more about OneTick, please visit onetick.com, email info@onetick.com, or request a private demo here.

Best wishes,

Peter Simpson, OneTick Product Owner