By Shailesh Dwivedi, Head of Buy-Side Regulatory Solutions at OneTick

In an era of fragmented liquidity, high-frequency trading, and evolving asset classes like crypto, the demands on compliance teams have never been higher. Firms are looking for more than just a checklist of regulatory obligations; they need a system that adapts to their unique trading flows. While legacy providers like Nasdaq SMARTS have long been the standard, today’s market requires a platform that goes beyond "black box" logic.

OneTick Trade Surveillance offers a robust foundation for market integrity, combining the power of a high-performance time-series database with the flexibility of a modern analytics lab. Here is how OneTick helps you start on the good foot, delivering capabilities that are competitive with—and go significantly beyond—standard market offerings:

1. Transparency Over "Black Box" Logic

One of the most common frustrations with traditional surveillance vendors is the inability to understand why an alert triggered or how to modify it.

- White-Box Models: Unlike competitors that hide their logic, OneTick defaults to "white-box" models. We are willing to provide source code for our models—whether rules-based, statistical, or non-linear—so compliance teams can fully understand and justify them to regulators.

- Dynamic Calibration: We move beyond static thresholds. OneTick supports dynamic parameters that adjust automatically to market conditions, such as average spread or volatility over a moving window. This reduces false positives without requiring constant manual tuning.

- The "Tune" Dashboard: When manual adjustment is needed, our Tune Dashboard allows users to modify parameters and run "sandbox" simulations against historical data to verify results before pushing changes to production.

2. Unmatched Performance and Data Granularity

OneTick is not just a software application; it is built on the OneTick proprietary time-series database, the same engine used by the NYSE to process over one trillion messages per day.

- Real-Time Complex Event Processing (CEP): While many systems rely on T+1 batch processing, OneTick supports CEP for real-time monitoring. This allows for immediate detection of market disruption events or the triggering of algo kill switches within milliseconds.

- Cross-Product Capabilities: We excel at detecting manipulation across correlated assets. This includes structural correlations (e.g., an equity underlier and its options) and non-structural correlations defined by custom correlation matrices (e.g., different chip stocks).

- Full Order Lifecycle: Our data model captures the entire lifecycle of an order, including parent-child relationships and interactions with the order book, ensuring no detail is lost in aggregation.

3. Beyond Standard Alerts: The SC(A)IL Environment

Where OneTick truly steps beyond the competition is in our Smart Compliance Insights Lab (SC(A)IL). This SaaS environment allows compliance teams to go beyond the standard dashboard and perform deep, ad-hoc investigations.

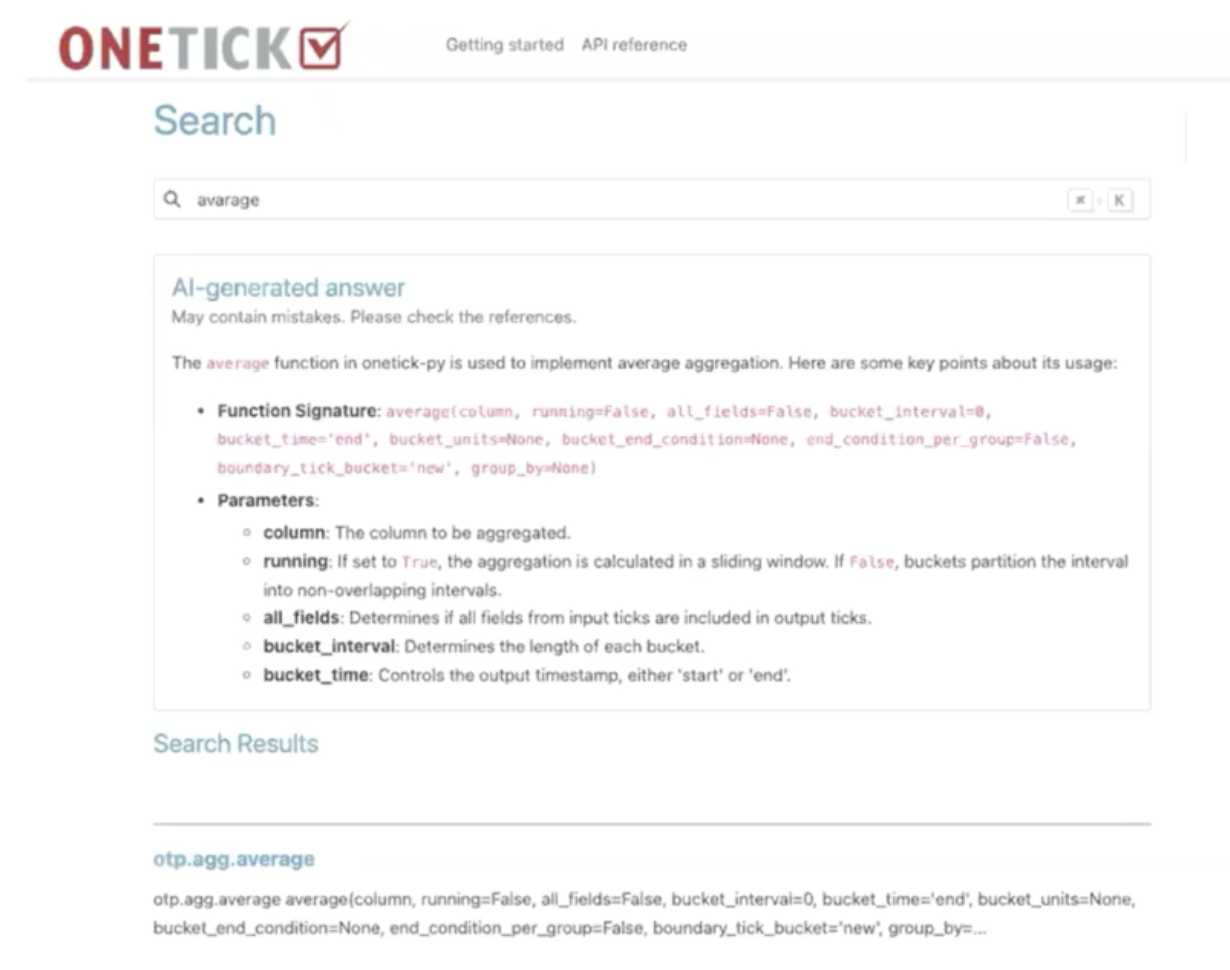

- Ad-Hoc Querying: SC(A)IL provides a JupyterLab environment where users can query their data using SQL, Python, or OneTick’s high-performance analytics libraries.

- AI-Powered Assistance: SC(A)IL features a Retrieval Augmented Generative (RAG) AI assistant. Users can write natural language prompts to generate code for custom reports or queries, leveraging knowledge of the specific data schemas.

- Guest Alerts: Users can develop their own custom logic in SC(A)IL and schedule it to run as a "guest alert," effectively fast-tracking the deployment of new surveillance models outside the standard software development lifecycle.

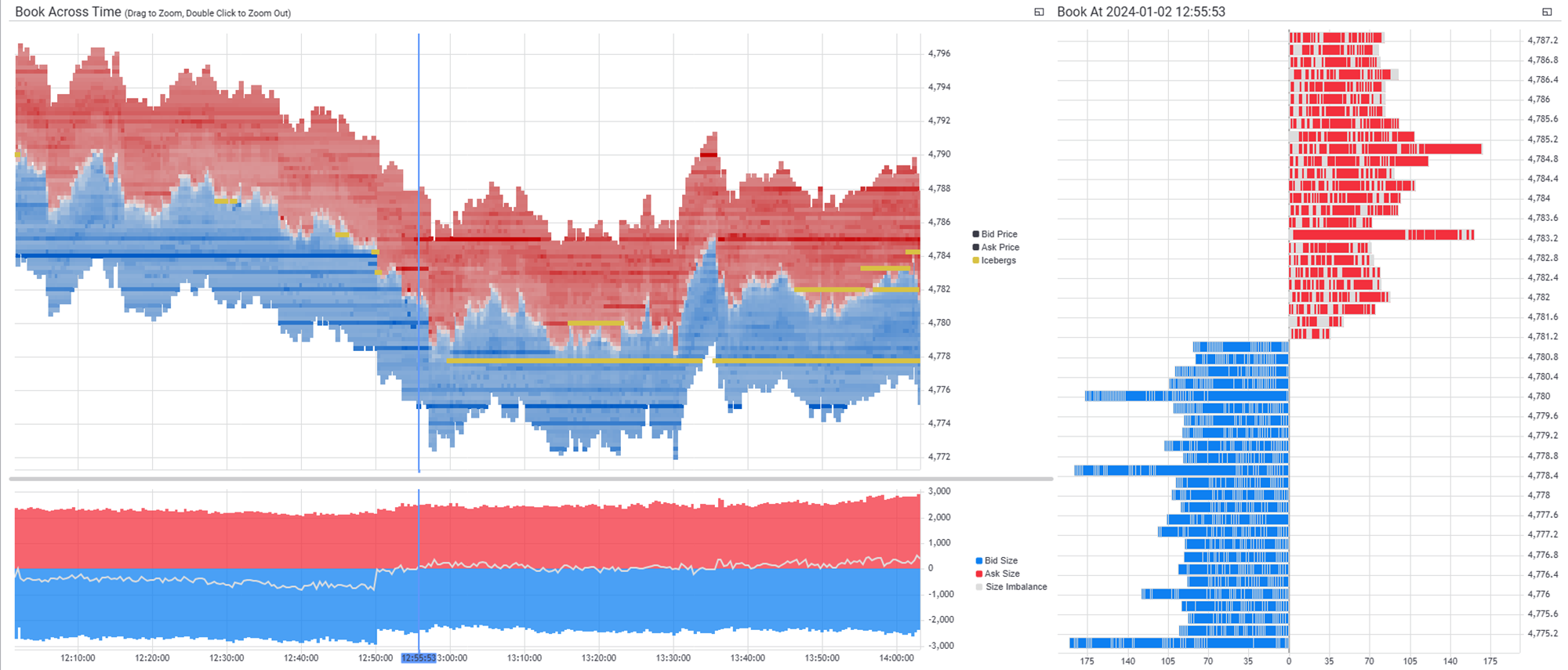

4. Visualizing the Narrative: OrderBook Replay

Context is everything. When an alert triggers, analysts need to see the market as the trader saw it.

- Market Replay: OneTick provides a dynamic OrderBook Replay (OBR) that visualizes the full depth of book (L3 data). Analysts can step through market events tick-by-tick, overlaying news and alerts on the timeline to reconstruct the exact scenario of an alleged manipulation.

- Participant Perspective: The system can filter the view to show the specific participant’s orders interleaved with market data, visualizing exactly how their orders interacted with the flow.

5. Comprehensive Coverage Out-of-the-Box

While our advanced features set us apart, we also provide the comprehensive coverage you expect from a tier-one vendor.

- Global Reach: We cover 200+ markets and global regulations including MAR, MiFID II, SEC, FINRA, CFTC, and IIROC.

- Extensive Alert Library: Our standard library includes robust models for Layering and Spoofing, Insider Trading, Wash Trading, Marking the Close, and Front Running, among many others.

- Crypto and Digital Assets: We offer specialized support for crypto markets, including handling artificial tick sizes and cumulative size curves for fragmented liquidity.

Conclusion

Choosing a surveillance system is like building a house: you cannot build a stable structure on a shaky foundation. OneTick provides the strongest data foundation in the industry, paired with the transparency and advanced analytics required to navigate modern financial regulation. Whether you choose our fully hosted SaaS solution or an on-premise deployment, OneTick ensures you hit the ground running and stay up to speed.

Visit onetick.com, email info@onetick.com, or request a private demo here.

Contact us today to set up a personalized walkthrough of these capabilities.

Best wishes,

Shailesh Dwivedi, Head of Buy-Side Regulatory Solutions at OneTick