By Shailesh Dwivedi, Head of Buy-Side Regulatory Solutions at OneTick

Anticipation is building for next week’s XLoD Global Conference in London.

The OneTick team is excited to demonstrate how our Surveillance suite is leveraging AI to elevate our customers’ experiences, including automating routine tasks, enhancing data analysis, and enabling real-time, data-driven decision-making in risk management and compliance.

Introduction to OneTick Surveillance

The OneTick Surveillance suite is used by Regulation, Sell-side, and Buy-side for both 1st LoD (trading & supervision) and 2nd LoD (compliance & regulation). We offer pluggable modules and features including:

- Common core for all use cases

- Mix-and-match modules

- Special purpose modules (e.g. PAD)

- Selectable features a.k.a. cost-effective

First Line of Defense: Trading & Supervision

The first line owns and manages risks as part of daily operations. AI tools here focus on real-time anomaly detection and process automation. You want to be the most cautious here as AI offerings can deliver more promise than fact.

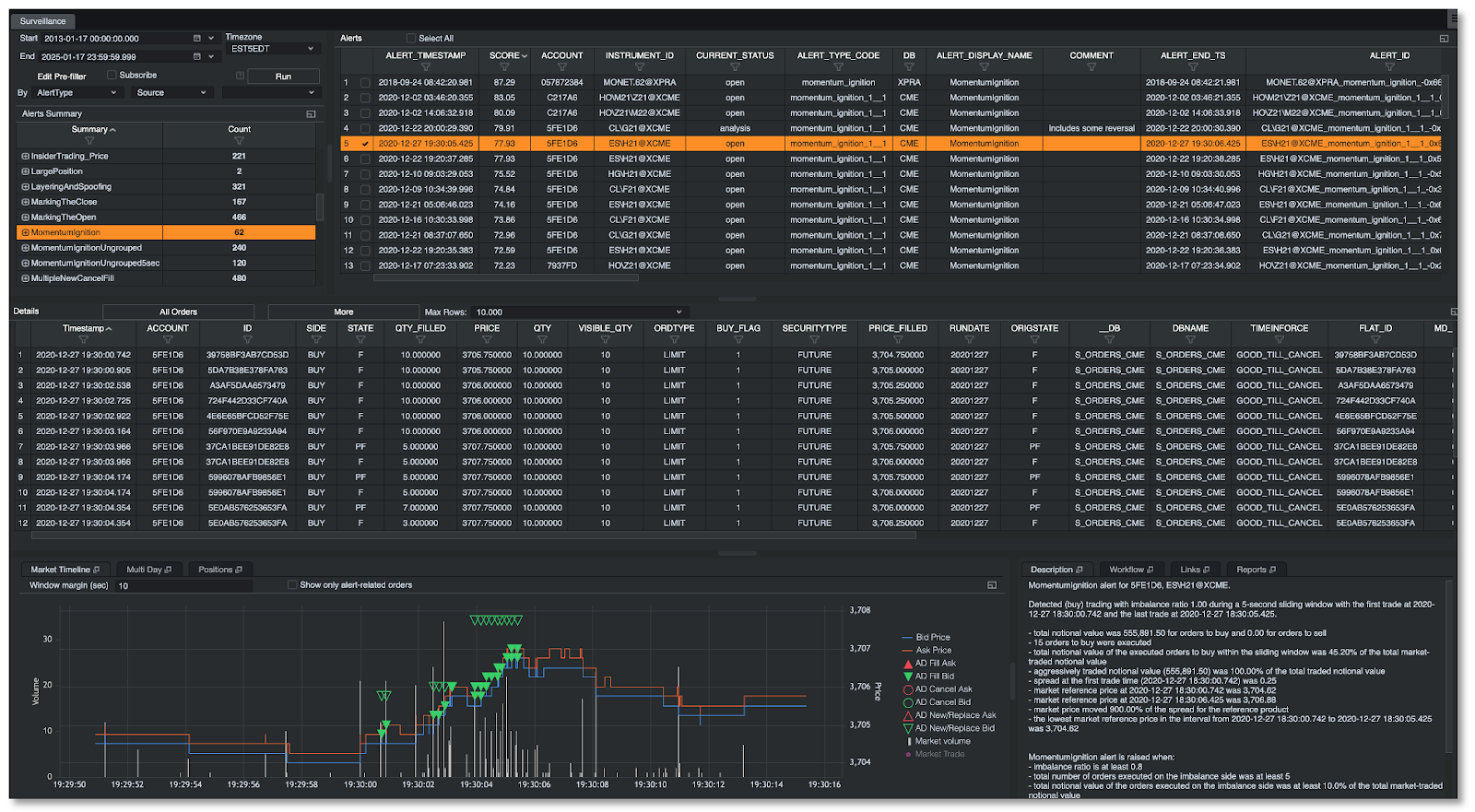

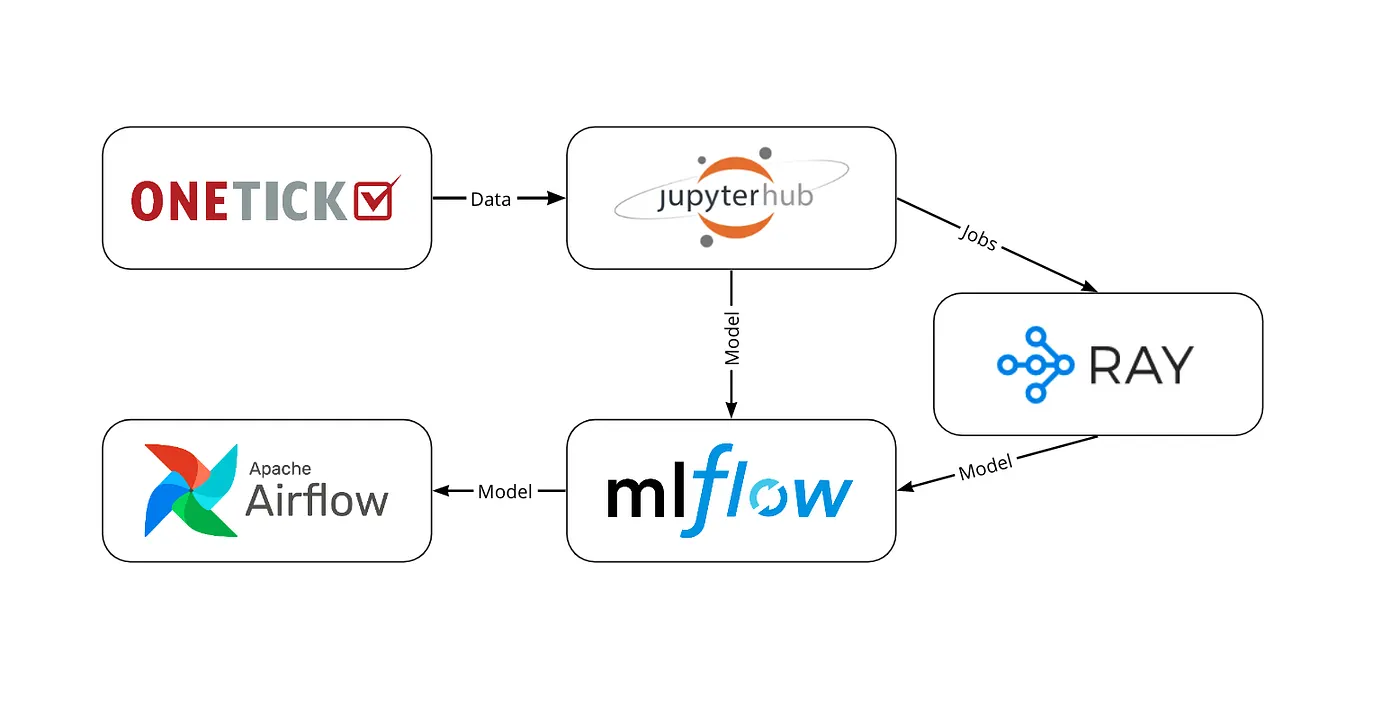

At OneTick, we’ve developed smarter alert scoring models with low false positive rates using complete ML and MLOps. Crucially, this step comes with complete auditability. Get the clarity you need while maintaining explainability for strict requirements.

Smarter scoring doesn’t just minimize false positives; it also amplifies true positives, suppresses false negatives, and effectively leverages weak cases (‘near misses’).

Using ML, OneTick ranks alerts based on internal indicators of abusive behavior. This allows analysts to prioritize investigations by focusing on the strongest cases. For SaaS customers, this extends to unsupervised clustering to determine trader cohorts and compare behavior against norms.

OneTick’s alert calibration offers an unmatched level of flexibility:

- Compare date-range trials in sandbox mode.

- Tune alert parameters per flow, per market, even per product.

- The score is calculated by each alert, with automatic threshold categorization.

- Smart alert models tune themselves to market conditions.

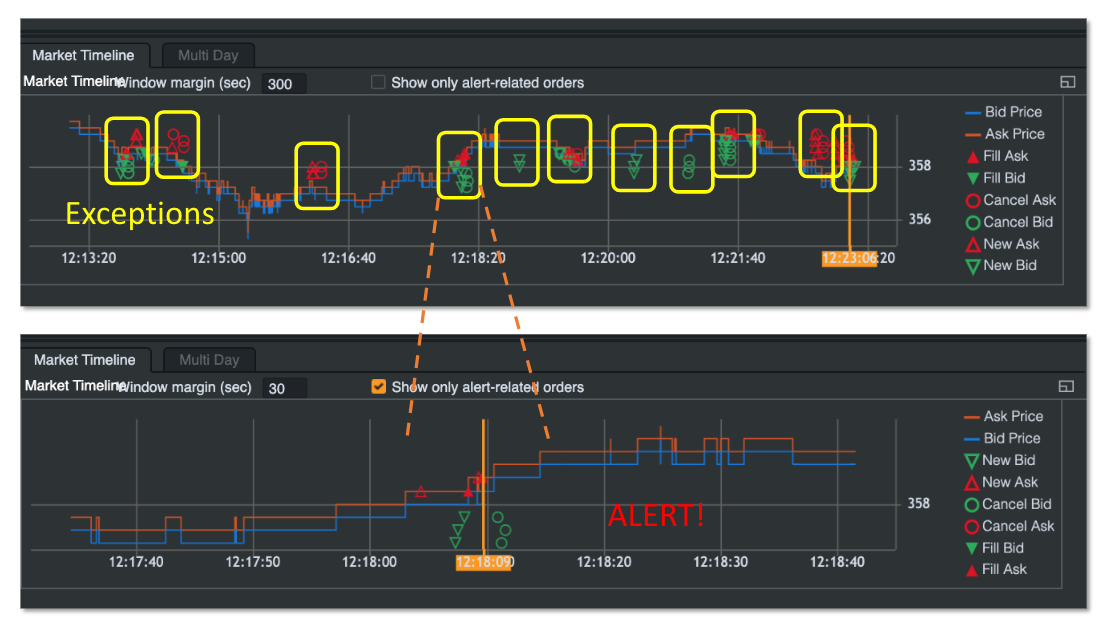

- Alerts can also be designated as exceptions or reports.

- Use pattern alerts over exceptions to greatly reduce alert volumes.

- Aggregate weak cases for greater understanding.

- Calculate metrics such as P&L for a manipulative activity over time.

- Market and trader profiling takes it to the next level (e.g. clustering).

Going from 1,000 exceptions to 10 alerts

Second Line of Defense: Compliance & Regulation

The second line provides oversight and challenges the first line's risk management activities. AI helps these functions with continuous monitoring and analysis of vast datasets to ensure adherence to policies and regulations, such as MAR, MiFID II, SEC, FINRA, and IIROC, all covered by OneTick Surveillance.

Some examples of 2LoD use cases:

- Continuous Compliance Monitoring – AI systems tirelessly monitor transactions and internal processes for subtle patterns that might indicate money laundering or other compliance breaches, a task that is resource-intensive for human analysts.

- Model Risk Management – AI is used in advanced models for stress testing, capital optimization, and market impact analysis, helping the second line to independently review and validate the AI models used by the first line.

Main triage dashboard

Third Line of Defense: Internal Audit and Independent Assurance

The third line provides independent assurance to the board and senior management that the first and second lines are operating effectively. AI enhances the scope and efficiency of audits.

While data and audit trails generated by OneTick would be essential resources for a third-line audit, our software itself does not perform the independent auditing function. The third line involves an unbiased evaluation by auditors who are not directly involved in the day-to-day risk management operations or the use of the surveillance system itself.

What’s Next

Will we see you at XLoD Global London 2025 next week? Schedule a call with our team ahead of the event to share your perspective, your pain points, and see how you can upgrade your surveillance with OneTick.

Not in London? No problem! You can request a demo any time using this link and stay tuned for more exciting projects from the OneTick team by subscribing to the OneTick Blog today.

Best wishes,

Shailesh Dwivedi

OneTick Head of Buy-Side Regulatory Solutions