By Rosalie Ellis, Director of Sales at OneTick

This September, I had the pleasure of representing OneTick at the first-ever XLoD Global in Asia, hosted at the Marina Bay Sands Expo and Convention Centre in Singapore. The event was phenomenal, bringing together over 300 executives from the region's largest financial institutions to debate the future of non-financial risk, compliance, and control.

Between the insightful panel discussions and the engaging conversations I had with attendees, a clear picture emerged: the industry is rapidly moving toward intelligent, integrated, and holistic surveillance platforms that can effectively manage the growing complexity of both external market abuse and internal misconduct.

Here are the key takeaways that have stuck with me—and the problems we at OneTick are dedicated to solving.

AI isn’t a buzzword–it’s essential for efficient surveillance

A major theme at the conference was the challenge of "Effectively Integrating AI and Driving Innovation in Risk & Controls." With rising market complexity and stricter regulations, firms are drowning in data and alerts. The question on everyone’s mind was how to separate the signal from the noise.

This is where intelligence becomes a key differentiator. The answer isn’t just more rules, but smarter analysis. That’s why OneTick continues to work on leveraging Machine Learning (ML) and Artificial Intelligence (AI) to reduce false positives and improve alert accuracy. We continue to build out on features such as:

- Self-tuning alert models that automatically adjust parameters based on market conditions, reducing the need for constant manual intervention.

- ML-powered alert scoring, which ranks alerts based on indicators of abusive behavior so analysts can prioritize the most critical investigations.

-

A commitment to explainability, providing white-box models and even source code to ensure transparency and build trust with regulators.

THE PERIMETER ISN’T JUST EXTERNAL: MANAGING EMPLOYEE CONDUCT RISK

Discussions at XLoD Global repeatedly highlighted that risk doesn’t just come from external actors; it can also stem from within an institution's own walls. Employee misconduct was a key topic, emphasizing that firms face the critical challenge of overseeing employee trading to ensure compliance with both internal policies and regulatory obligations.

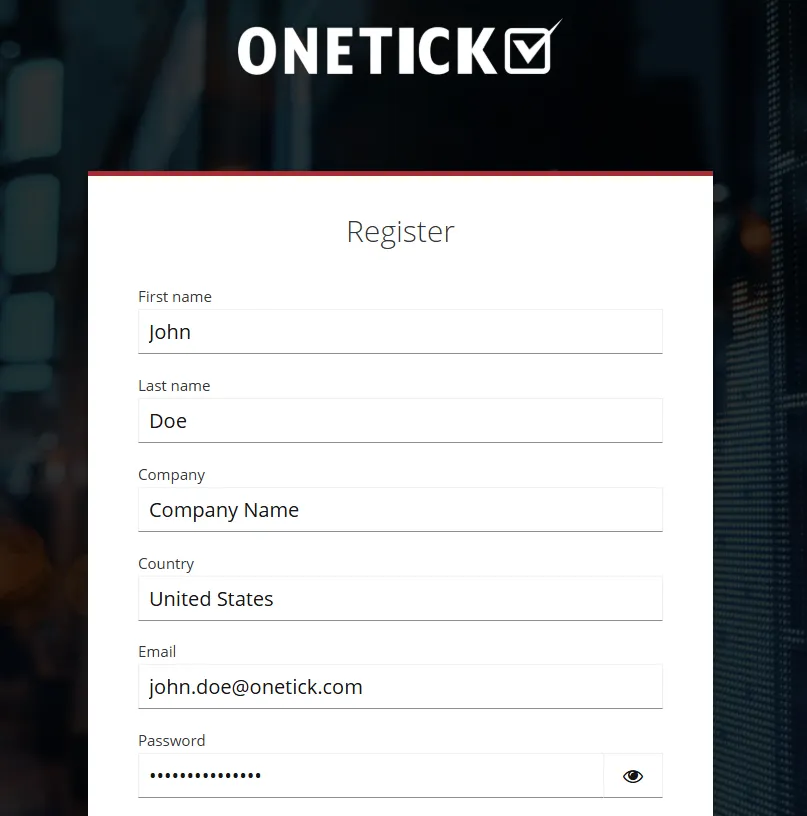

This is precisely why we developed the OneTick Personal Account Dealing (PAD) Surveillance Module. It provides a dedicated, robust solution to manage these specific risks. We've designed it with the necessary controls for such sensitive data, including:

- Segregated User Access, ensuring only designated compliance personnel can access employee trading data, independent of other surveillance modules.

- Independent Perimeters, allowing firms to set custom surveillance thresholds for employee accounts without affecting broader market abuse models.

- A Customizable Web Dashboard for efficient investigation and case management of employee trading alerts.

A unified front: Holistic surveillance across markets, across products

The interconnectedness of modern finance means that manipulative behavior rarely occurs in a vacuum. I heard from many attendees about the difficulty of tracking potential misconduct across different asset classes and markets. Why build and maintain separate, siloed stacks when a unified platform is more effective and efficient?

OneTick was designed to provide this unified view. Our platform delivers powerful cross-product and cross-market surveillance capabilities to detect manipulation across correlated instruments, whether they are structurally linked (like an equity and its options) or not. We empower firms to:

- Run surveillance across all asset classes, from equities to FX forwards, to detect complex patterns like "mini manipulation" or cross-product insider dealing.

- Ingest and analyze vast amounts of data, with the capacity to handle over 600+ billion messages per day, ensuring scalability for even the most active firms.

- Leverage a single, powerful analytics engine for all compliance needs, from real-time alerts to T+1 reporting and deep-dive investigations using our Smart Compliance Insights Lab (SC(A)IL).

WHERE DO WE GO FROM HERE?

My time at XLoD Global Singapore drove home four key themes for the future of compliance and risk management:

- AI-driven efficiency is no longer a luxury but a necessity for managing alert volume and focusing on true risk.

- A holistic view is essential, as surveillance must cover cross-product, cross-market, and internal employee activity.

- Dedicated solutions are needed for specific challenges like Personal Account Dealing to ensure robust and segregated oversight.

- A unified platform beats fragmented toolkits by providing a single, scalable, and powerful foundation for all compliance and risk functions.

At OneTick, we are committed to empowering firms to navigate market volatility and regulatory change with confidence. We offer battle-tested reliability and scalability to handle any regulatory regime, from MAR and MiFID II to FINRA and beyond.

If you’re thinking about how to future-proof your surveillance and risk strategy, let’s talk!

— Rosalie Ellis, OneTick Sales