By Ross Dubin, SVP – Global Head of Sales at OneTick

In today's fast-paced financial markets, ensuring fair and transparent trading is paramount. Market abuse, ranging from manipulative behaviors to insider dealing, poses significant risks to market integrity and investor confidence.

At OneTick, we understand these challenges and continually evolve our trade surveillance solutions to empower firms with the tools needed to identify, investigate, and act on anomalies effectively. Today, let’s explore how OneTick leverages advanced technologies like Generative AI (GenAI) alongside established best practices to combat market abuse.

OneTick's Comprehensive Surveillance Capabilities

To start, let's go over the robust suite of capabilities from OneTick Surveillance which enable our clients to detect a wide array of trading patterns and market misconduct activities. Our standard alert library is extensive, covering critical areas such as:- Spoofing and Layering: Including variants designed to cover specific legal cases and various "flavors" of layering and spoofing, such as "Post and Flip" and "Layering below the BBO."

- Insider Trading: Featuring alerts like "Position Accumulation," "Insider Trading Pattern alerts," and those for conflicts of interest involving wall-crossed traders or directors. These can be augmented with news, excess return, liquidation, and aggressiveness checks.

- Wash Trading and Cross Trading: Customizable to detect circular trading patterns, often associated with money laundering.

- Front-running: Covering several variants, including stop loss trigger, take profit front running, and tailgating/trade-along.

- Market Manipulation: A broad category encompassing pump and dump, fix manipulation (e.g., Marking the Close), dark pool manipulation, and unusual trader and market activity.

Our system supports various alert operating modes—Complex Event Processing (CEP)/real-time, intraday, and T+1/daily—to suit different risk scenarios and latency requirements, from market disruption alerts (CEP) to multi-day insider dealing profiles (T+1). This flexibility ensures that firms can monitor effectively across all time horizons.

Specializing in Personal Account Dealing (PAD) Surveillance

Beyond general market abuse, firms face specific challenges in monitoring employee trading activities to ensure compliance with both internal policies and regulatory requirements. OneTick addresses this with its new Personal Account Dealing (PAD) Surveillance Module, a dedicated and robust solution for these specific challenges. This module offers:

- Customizable Web Dashboard: Designated internal compliance analysts can easily access, investigate, and take action on employee trading alerts through an intuitive web-based interface.

- Segregated User Access: The PAD Module supports a separate set of internal compliance users, ensuring that only designated personnel have access to this sensitive data, independently of other surveillance modules.

- Independent Perimeters: Firms can define their own set of independent perimeters and thresholds specifically for personal account dealing, allowing for customized surveillance models without affecting the parameters used for other surveillance activities.

This module provides compliance teams with the granular control and dedicated tools needed to effectively monitor and manage potential risks associated with employee trading.

The Strategic Role of AI and Machine Learning

The fight against market abuse is continuously enhanced by AI and Machine Learning (ML). OneTick strategically employs these technologies to reduce false positives and trigger alerts more intelligently. Key applications include:

- Self-Tuning Alert Models: These models leverage machine learning to adjust their internal parameters dynamically based on market conditions, significantly reducing the need for manual tuning and making alerts more adaptable and accurate. This helps in reducing false positives, for example, in layering alerts by modeling the impact of passive orders under different conditions.

- Alert Scoring with Machine Learning: ML models calculate scores to rank alerts, prioritizing the strongest cases. This often involves statistical methods like clustering to evaluate trading activities against historical data of similar market participants, minimizing irrelevant alerts.

- Unsupervised Clustering: This technique helps to determine a trader’s cohort, enabling comparisons against group norms, which is especially useful when individual historical data is insufficient to identify deviations.

For customers, the explainability of ML models is crucial. OneTick prioritizes "white-box" models, offering transparency and even source code for rule-based, statistical, and non-linear models. For more complex GenAI capabilities, such as those used in SC(A)IL, OneTick maintains strict controls over inputs, outputs, data access, and provides detailed narrative explanations and human-in-the-loop testing.

Conclusion: Best Practices for Effective Trade Surveillance

Beyond advanced technology, implementing best practices is key to a robust surveillance framework:

- Alert Calibration and Threshold Management: OneTick offers manually tunable parameters, dynamic thresholds that adjust to market conditions, alert sensitivity thresholds based on internal scores, and pattern alerts. Dynamic thresholds, which self-calibrate based on factors like spread or price volatility, are crucial for maintaining alert usefulness across diverse market conditions.

- Cross-Product / Cross-Market Monitoring: Recognizing that manipulation often spans multiple instruments, OneTick supports monitoring based on both structural correlations (e.g., underlier and options series) and non-structural correlations (using externally supplied correlation matrices). This allows for detecting complex, multi-market manipulative strategies.

- Robust Data Quality and Integrity: High-quality data is the foundation of effective surveillance. OneTick’s system includes rigorous data ingestion processes, normalization, and dynamic data QA through "sanity checks" at various stages to ensure completeness and correctness. Issues like incorrect formatting or unexpected metrics are flagged to prevent compromised analysis.

- Integrated Case Management and Workflow: Alerts are automatically swept into the Case Management System (CMS), which supports auditable compliance workflows, automatic assignment, user comments, document attachments, and KPI tracking throughout the alert lifecycle. This streamlines investigation and ensures regulatory compliance.

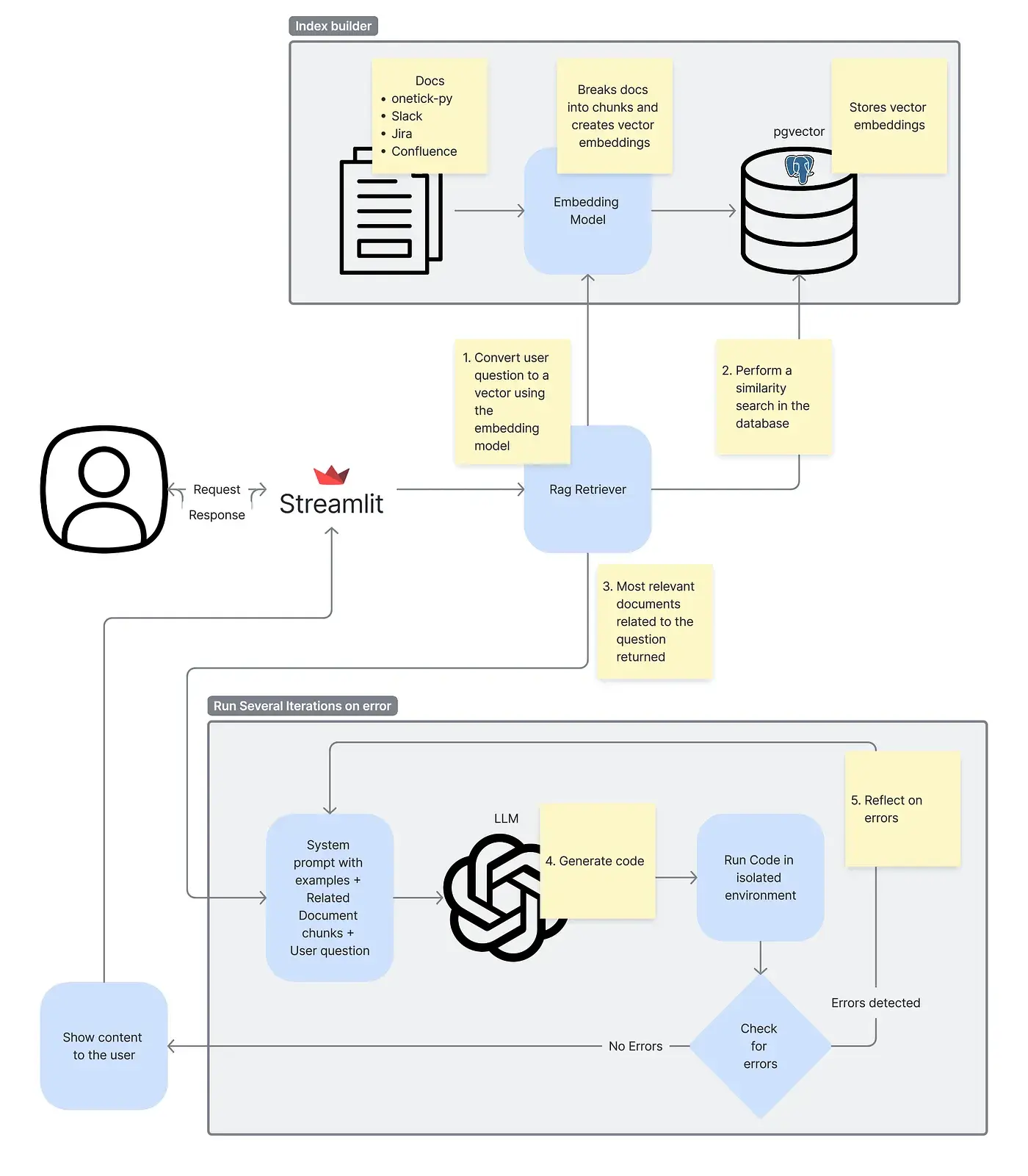

- Ad-hoc Analytics and Investigation with SC(A)IL: The Smart Compliance Insights Lab (SC(A)IL) provides a powerful SaaS environment for compliance analysts to conduct deep investigations. Leveraging JupyterLab, it allows users to ask ad-hoc questions using SQL or Python/Pandas, or even natural language with the RAGenAI assistant. Analysts can build custom reports, dashboards, and even "guest alerts," significantly enhancing their ability to explore and visualize data beyond standard alert contexts.

By combining comprehensive alert coverage, strategic application of AI and ML, and adherence to these best practices, OneTick provides a holistic and powerful solution for detecting and preventing market abuse. This integrated approach ensures that financial institutions can protect market integrity, meet regulatory obligations, and maintain a competitive edge in an ever-changing landscape.

Want to see OneTick Surveillance in action? Request a meeting with the OneTick team today to set up your free demonstration.

Until then,

Ross Dubin

OneTick SVP – Global Head of Sales