By Jeff Banker, SVP – Product, Data, and Market Development

8 min read

Institutional-Grade Market Data & Analytics for Hedge Funds: Accelerate Time from Tick to Signal

By Jeff Banker on Feb 10, 2026 11:54:53 AM

4 min read

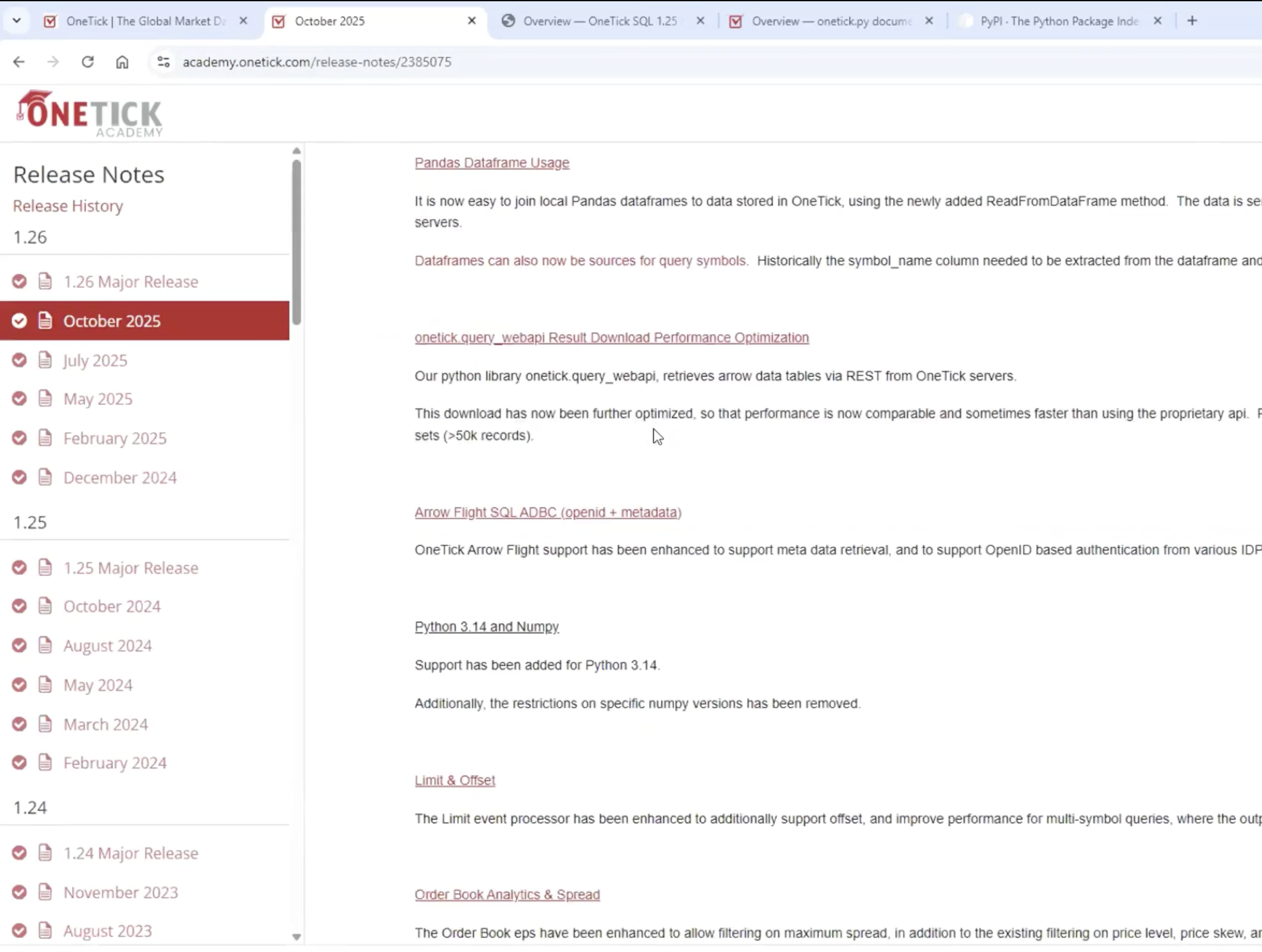

OneTick 1.26: Speed, Simplicity, and Zero Lock-In

By Peter Simpson on Jan 29, 2026 12:04:04 PM

By Peter Simpson, OneTick Product Owner

4 min read

The Quant’s AI Advantage: Moving Beyond Search to Agentic Coding

By Alexander Serechenko on Jan 22, 2026 11:48:04 AM

By Alexander Serechenko, Senior Python Developer and LLM Team Lead at OneTick

4 min read

Hit the Ground Running in 2026 with OneTick Trade Surveillance

By Shailesh Dwivedi on Jan 15, 2026 2:02:00 PM

By Shailesh Dwivedi, Head of Buy-Side Regulatory Solutions at OneTick

4 min read

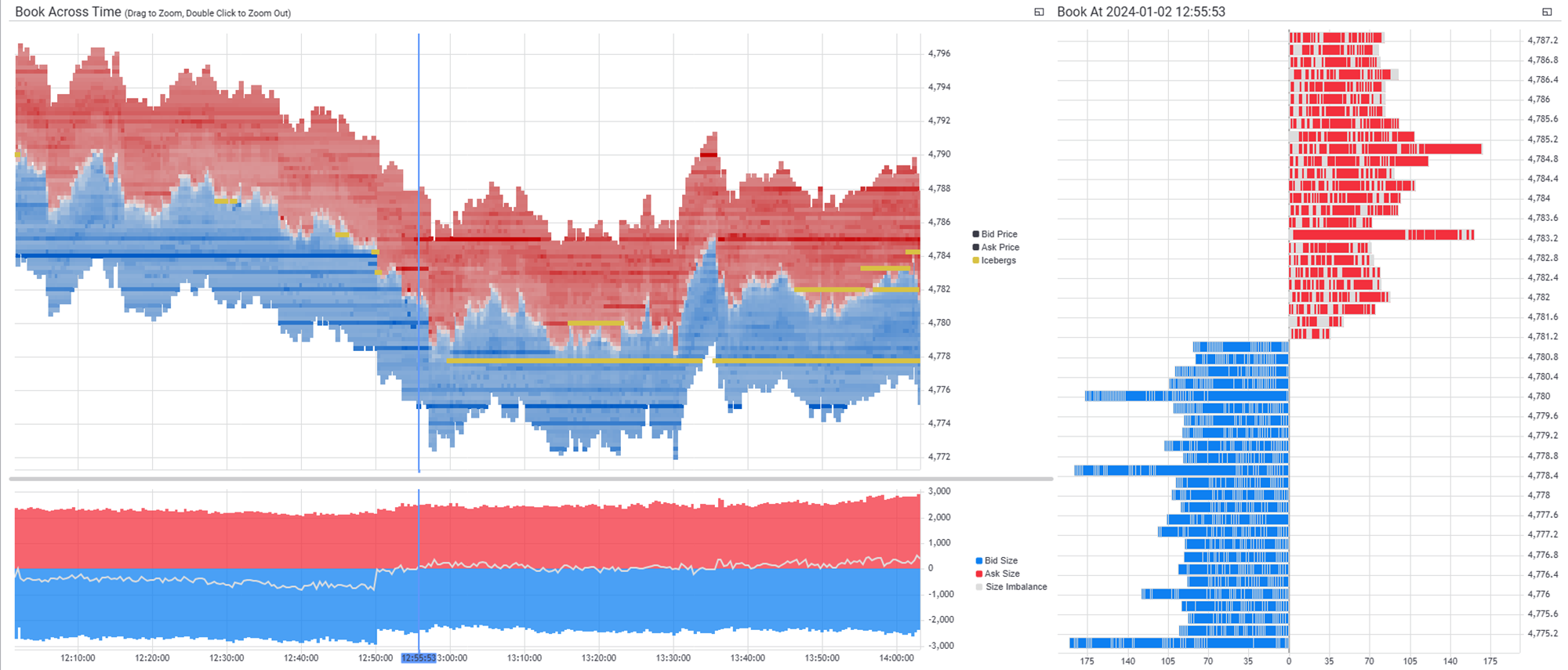

Unlocking Market Structure: Deep Dive into CME Market Depth with OneTick Cloud

By Peter Simpson on Dec 11, 2025 1:00:08 PM

By Peter Simpson, OneTick Product Owner. Demonstrated in webinar broadcasted May 7th, 2025

4 min read

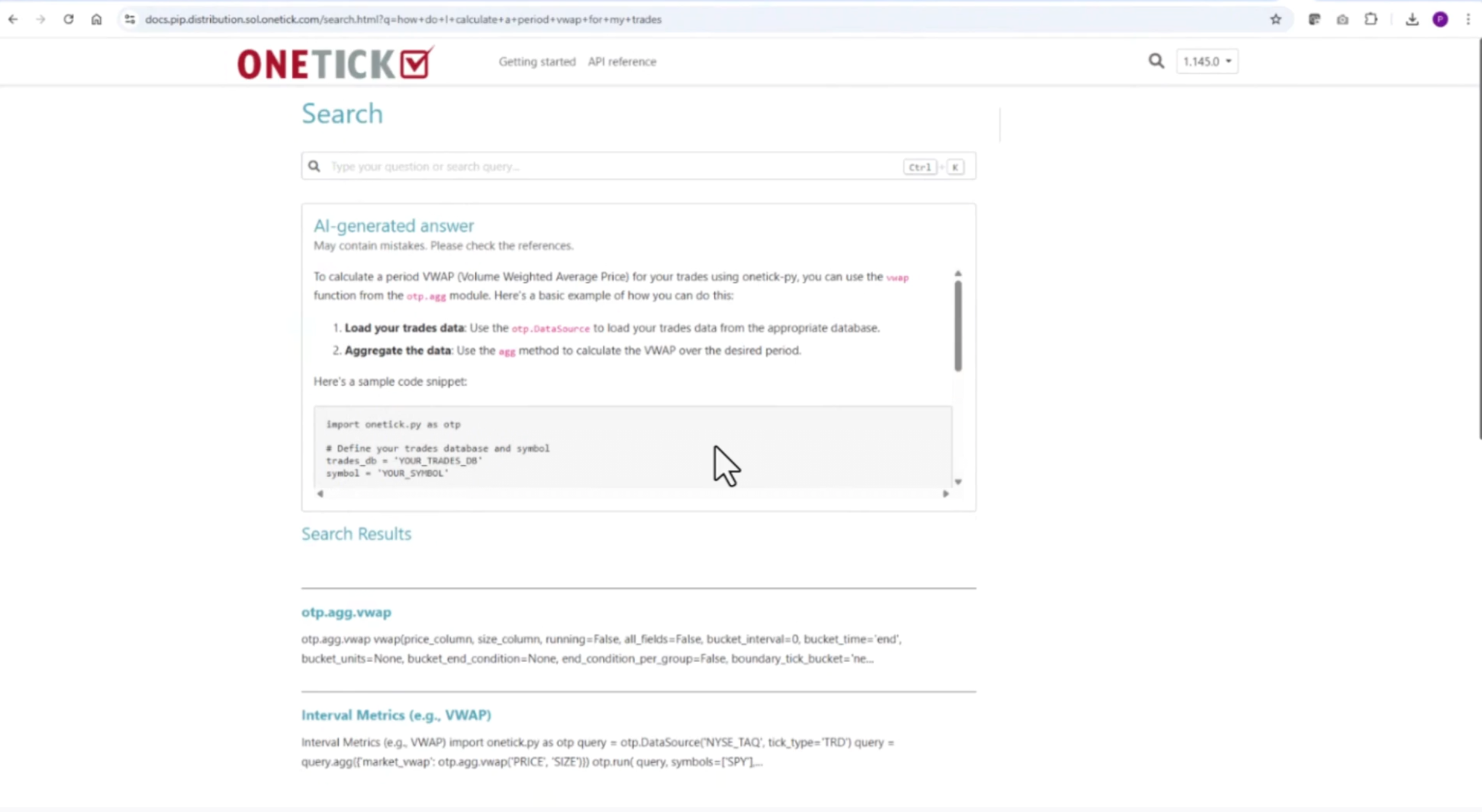

AI Takes the Helm: Leveraging Natural Language Assistance in Trading Analytics

By Alexander Serechenko on Dec 3, 2025 2:33:04 PM

By Alexander Serechenko, OneTick LLM Team Lead, and Peter Simpson, OneTick Product Owner

5 min read

Q&A with Peter Simpson: Low Latency Analytical Access for Market Data On-Demand

By Peter Simpson on Nov 20, 2025 11:34:22 AM

Webinar excerpt by Peter Simpson, OneTick Product Owner, originally broadcasted Nov. 18th, 2025

6 min read

How MCP Extends AI Agents with OneTick Product Features

By Tigran Margaryan on Nov 13, 2025 9:45:00 AM

By Tigran Margaryan, OneTick Software Engineer

4 min read

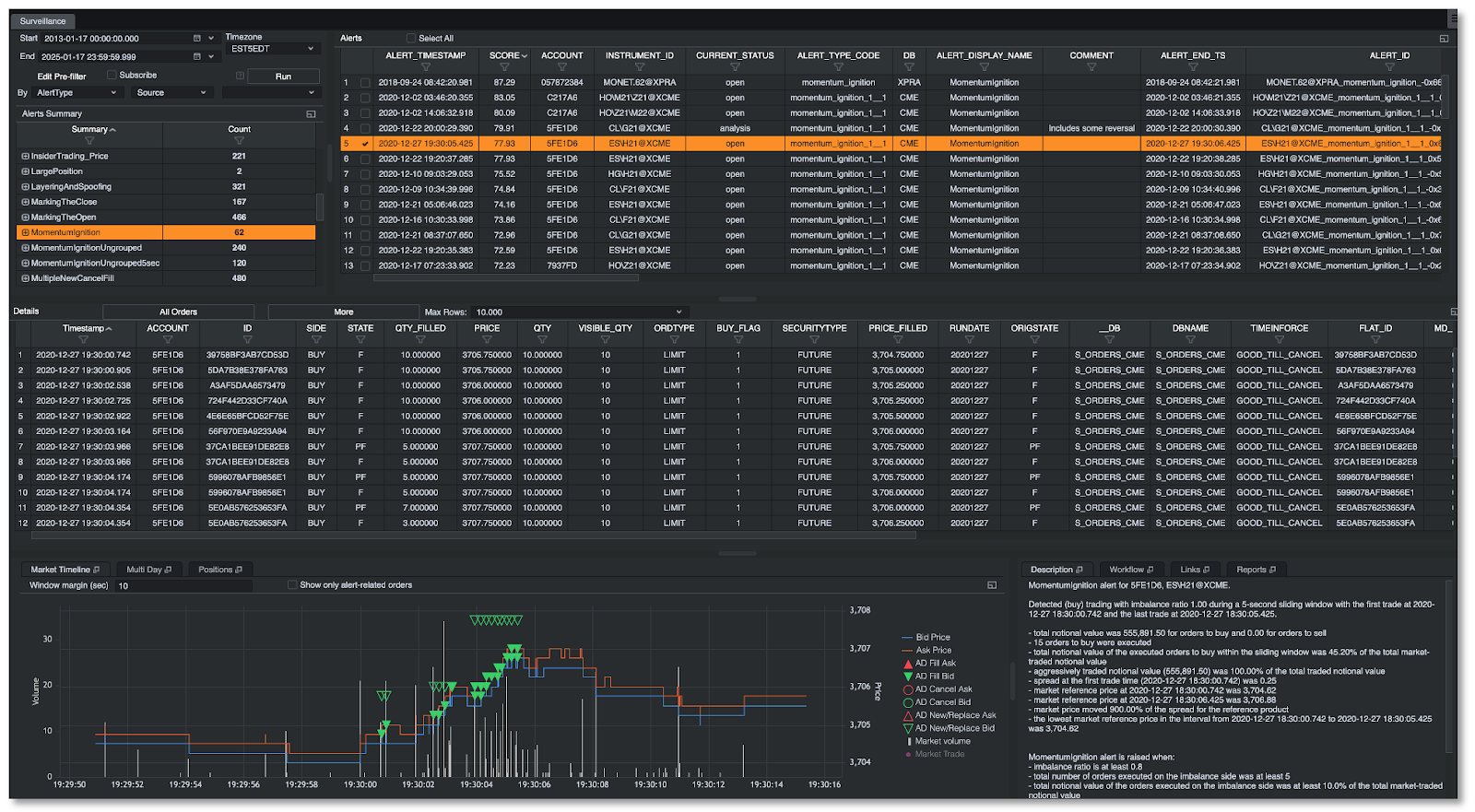

AI in Surveillance: Effective Use Cases Across the 3 Lines of Defense

By Shailesh Dwivedi on Nov 7, 2025 1:40:33 PM

By Shailesh Dwivedi, Head of Buy-Side Regulatory Solutions at OneTick

5 min read

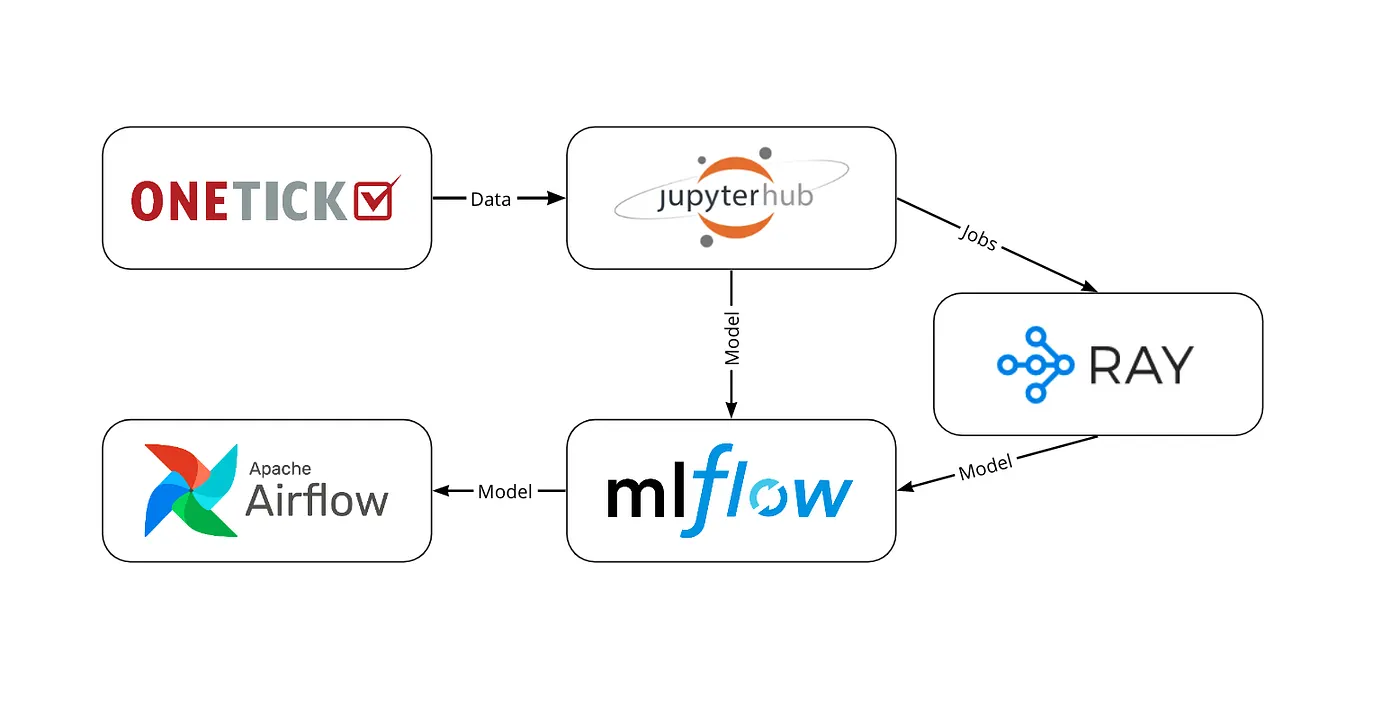

MLOps Architecture for Time-Series Experiments

By Alexander Serechenko on Oct 31, 2025 11:14:59 AM

By Alexander Serechenko, LLM Team Lead, Senior Developer & Platform Engineer at OneTick

4 min read

Data as a Differentiator: Preparing for Enterprise-Grade AI

By Mick Hittesdorf on Oct 24, 2025 11:58:33 AM

By Mick Hittesdorf, OneTick Senior Cloud Architect

6 min read

Support Assistant — Engineering Knowledge Companion

By Tigran Margaryan on Oct 16, 2025 10:30:00 AM

By Tigran Margaryan, OneTick Software Engineer

5 min read

Tick Data in the Crypto Age: Analytics & Compliance

By OneTick Marketing Team on Oct 9, 2025 1:10:43 PM

By the OneTick Team (Drawing on experience from Jeff Banker, Peter Simpson, & Phil Perrault)

4 min read

Navigating the New Frontier of Risk: Reflections from XLoD Global Singapore 2025

By Rosalie Ellis on Oct 2, 2025 1:31:10 PM

By Rosalie Ellis, Director of Sales at OneTick

17 min read

Basic Setup of WebAPI Access to OneTick Cloud

By Evgenii Grakov on Sep 25, 2025 10:45:00 AM

By Evgenii Grakov, Python Software Engineer at OneTick

5 min read

Reflections on Harnessing Modern Data Platforms Webinar

By Mick Hittesdorf on Sep 18, 2025 11:00:00 AM

By Mick Hittesdorf, Senior Cloud Architect at OneTick

15 min read

Creating Eval Cases for LLM-Generated Code

By Ruslan Galinskii on Sep 11, 2025 11:00:00 AM

By Ruslan Galinskii, Co-Head of Development at OneTick

5 min read

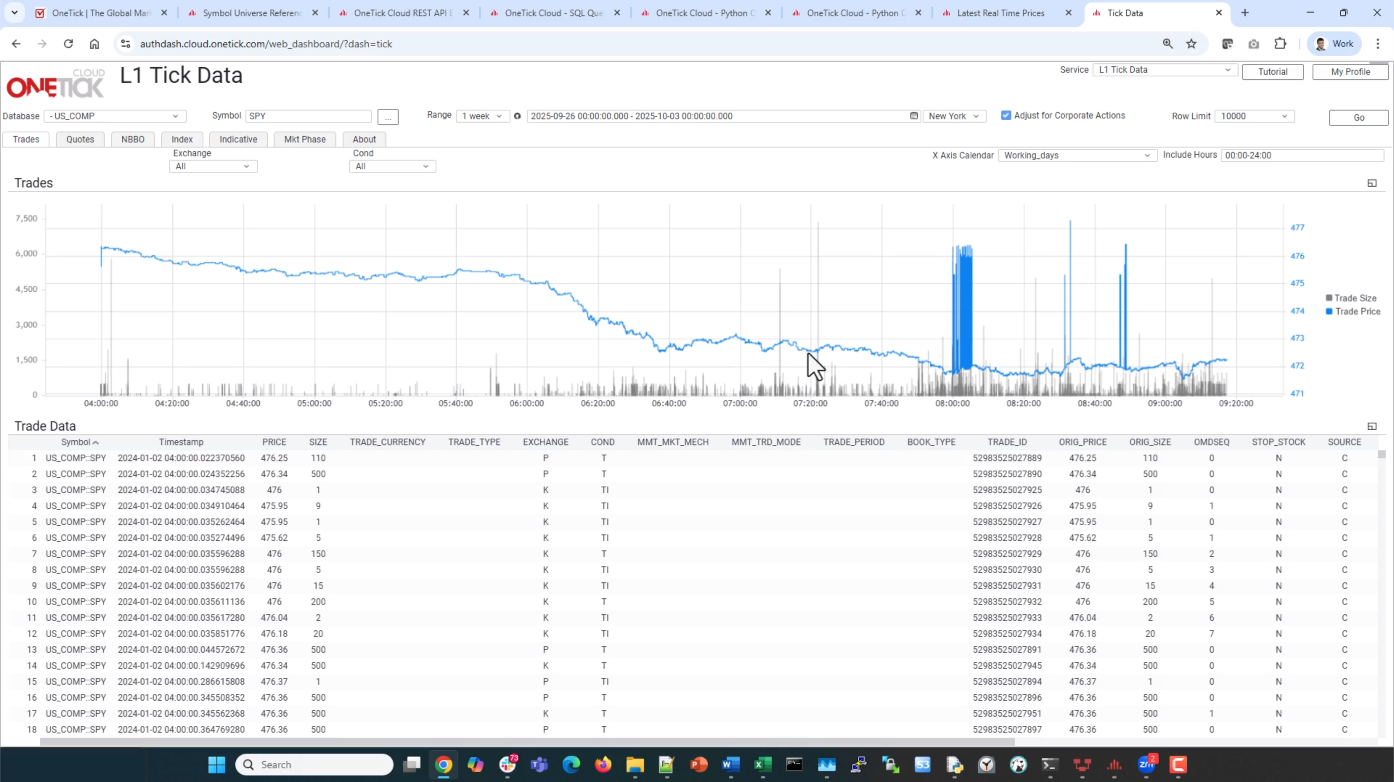

OneTick 101: SQL Analytics Against Historical Tick Data

By Mick Hittesdorf on Sep 4, 2025 11:00:00 AM

By Mick Hittesdorf, OneTick Senior Cloud Architect

5 min read

Market Abuse Detection: GenAI and Trade Surveillance Best Practices

By Ross Dubin on Aug 26, 2025 2:18:50 PM

By Ross Dubin, SVP – Global Head of Sales at OneTick

6 min read

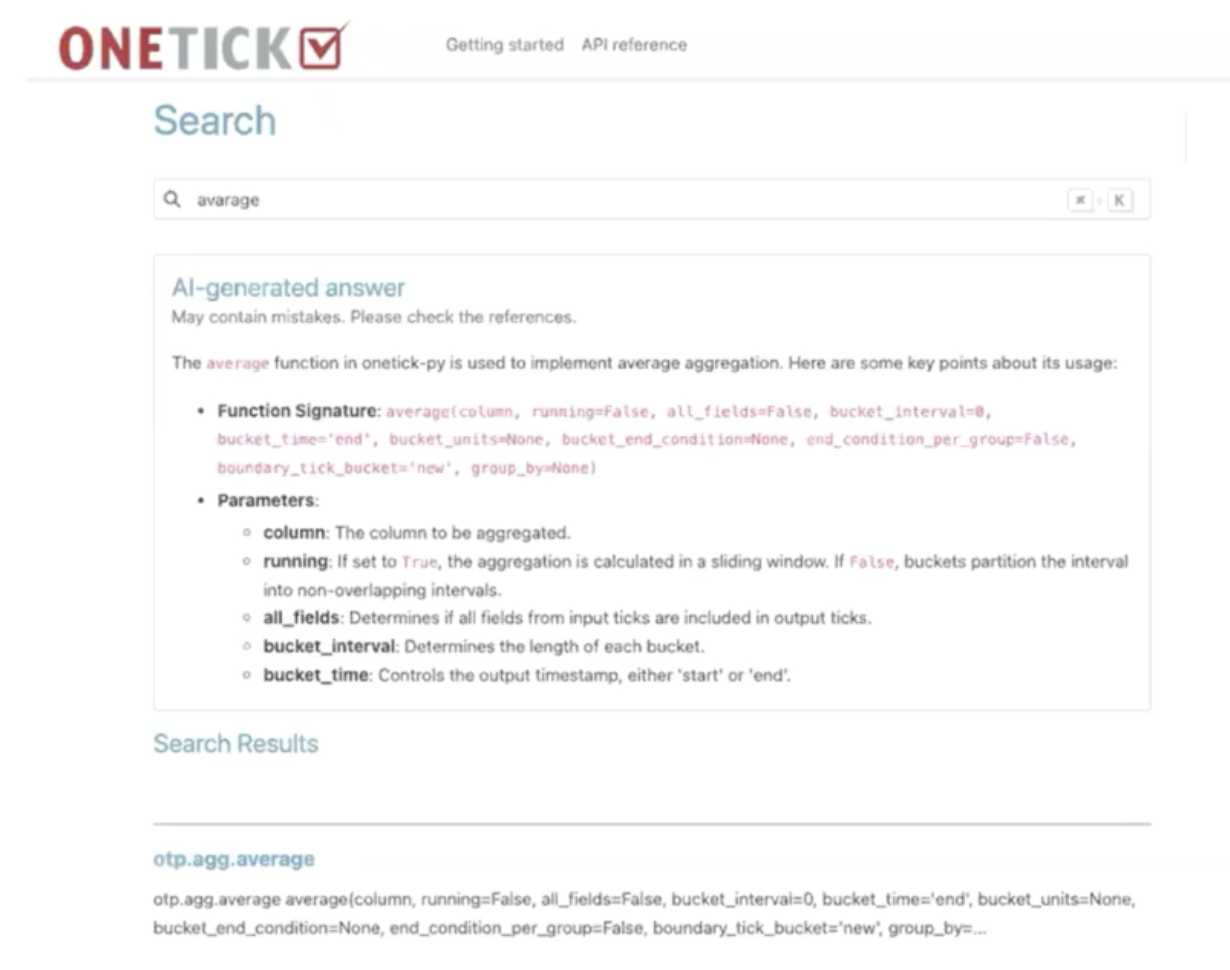

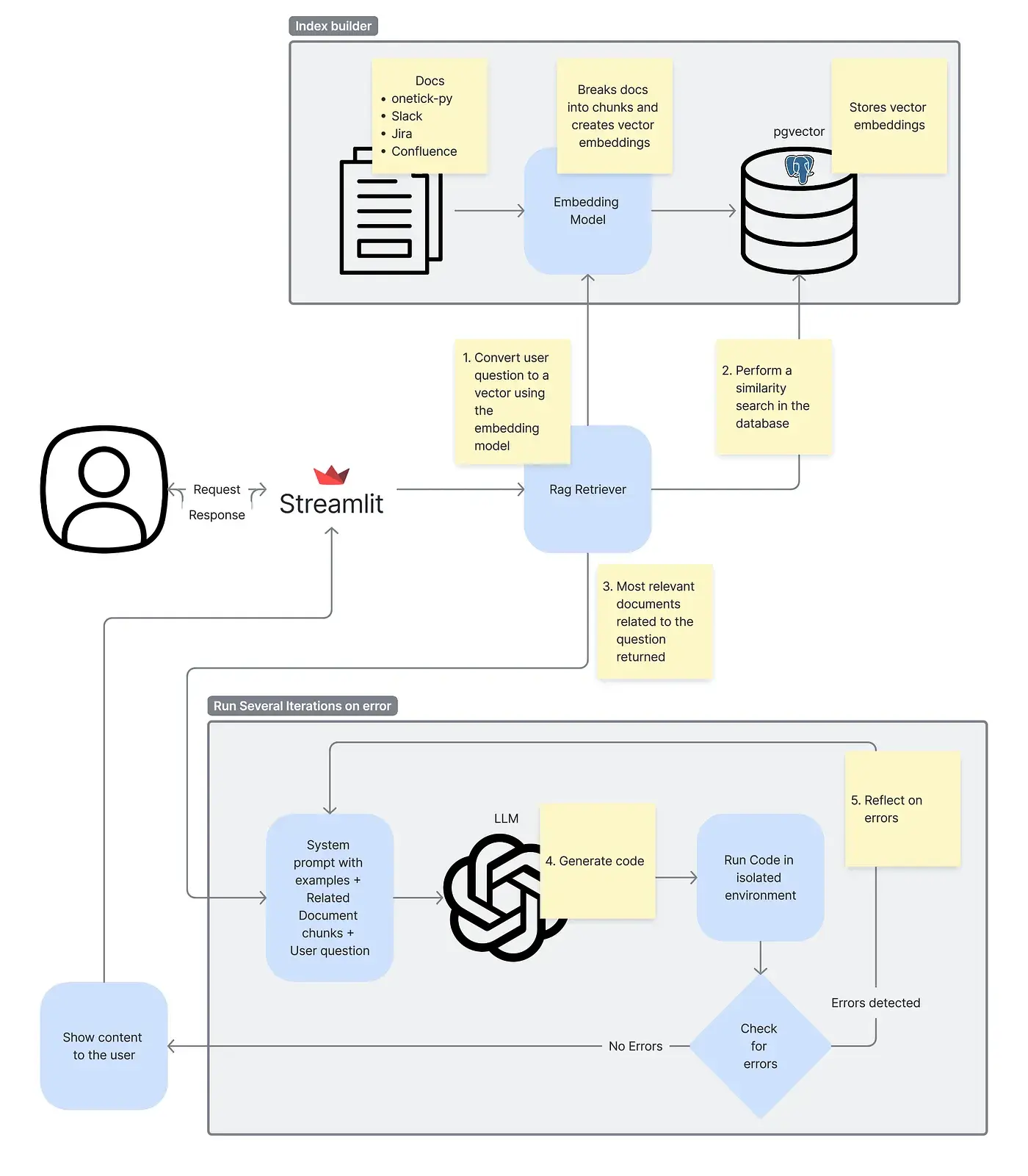

Coding Assistant for onetick-py

By Armen Avetisyan on Aug 21, 2025 12:59:51 PM

By Armen Avetisyan, Senior Software Engineer at OneTick

5 min read

The Case for Open Data Formats: Parquet and Iceberg

By Mick Hittesdorf on Aug 15, 2025 12:45:24 PM

By Mick Hittesdorf, Senior Cloud Architect at OneMarketData

4 min read

Let's Get Serious About AI in Capital Markets

By Mick Hittesdorf on Jul 31, 2025 3:02:50 PM

By Mick Hittesdorf, Senior Cloud Architect at OneMarketData

4 min read

Reflections on AI in Capital Markets and STAC Summit

By Mick Hittesdorf on Jul 24, 2025 1:47:20 PM

By Mick Hittesdorf, Senior Cloud Architect at OneMarketData

4 min read

Modernizing Tick Analytics with OneTick Cloud

By Mick Hittesdorf on Jul 11, 2025 12:03:38 PM

By Mick Hittesdorf, Senior Cloud Architect at OneMarketData